CSR: A Three-Letter Word with Great Impact

Have you ever wondered what the three letters CSR really mean? Corporate Social Responsibility (CSR) isn't just a buzzword; it’s a powerful force driving businesses to create positive change in society. In Mauritius, CSR is not just a voluntary act of kindness—it's a legal obligation for many companies. So, what’s the big deal with CSR, and why should it matter to both businesses and communities?

What Is CSR and Why Does It Matter?

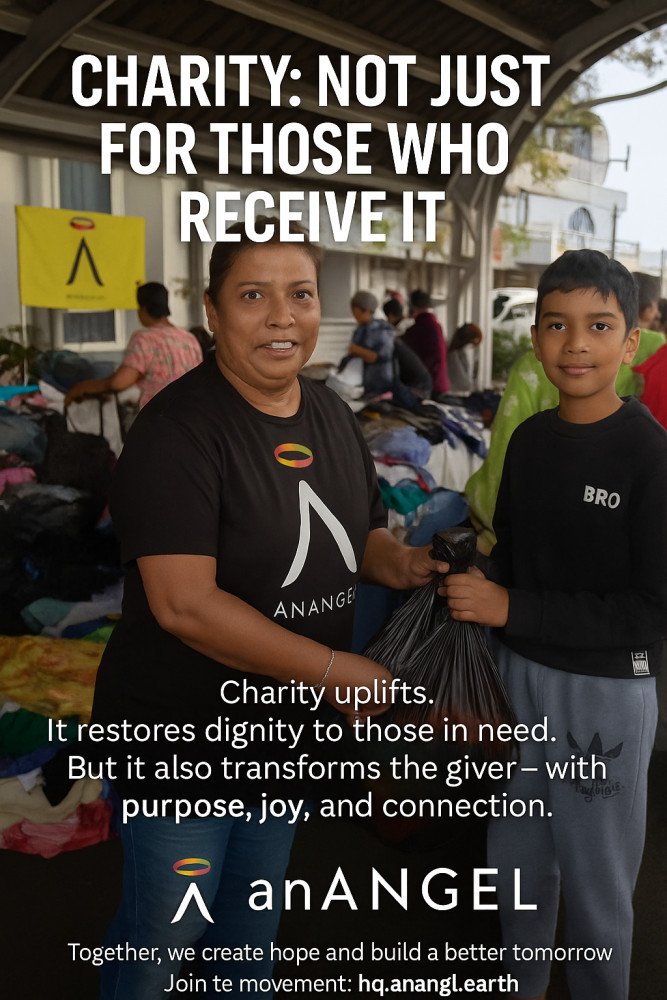

CSR stands for Corporate Social Responsibility—a concept that pushes businesses to go beyond profits and contribute to the greater good of society. This could be through environmental conservation, education, poverty alleviation, or supporting the health of local communities. Companies involved in CSR initiatives don't just improve their public image; they play an essential role in the sustainable development of the country.

But why should we care? Well, CSR benefits both businesses and society:

- For businesses, CSR creates a positive brand image, strengthens community relationships, and even enhances employee satisfaction.

- For society, it drives social development, helps reduce inequality, and promotes environmental sustainability.

In Mauritius, CSR is embedded in the law, meaning it has tangible, legal consequences for businesses.

CSR in Mauritius: The Law Behind It

In Mauritius, the law surrounding CSR is not just a recommendation—it’s a requirement for many businesses. Under the Finance Act of 2009 and CSR Regulations of 2014, companies with an annual turnover exceeding MUR 10 million must contribute at least 2% of their profits towards CSR activities. This can be done by supporting local NGOs, funding community-based projects, or engaging in activities that benefit society or the environment.

Why does this matter?

- It’s legally binding: If a business doesn’t comply with CSR requirements, they could face legal repercussions, including penalties.

- Encourages active citizenship: By contributing to social and environmental causes, companies help make a meaningful difference in the lives of people and the planet.

Who Can Benefit from CSR?

CSR is designed to support non-profit organizations, community initiatives, and environmental projects that align with the broader goals of the country. These can include:

- NGOs that focus on social development

- Community groups that tackle local issues like education, health, or sustainability

- Environmental projects that aim to protect biodiversity or promote climate change mitigation.

So, who can benefit? Essentially, any legitimate, non-profit entity with a focus on making a social or environmental impact can potentially receive support through CSR. Whether you’re an NGO fighting for education, a community group aiming to protect the environment, or a charity focused on healthcare, your project could be the next CSR initiative supported by a company in Mauritius!

How Can These Beneficiaries Get Involved?

For an organization to benefit from CSR, it must be eligible and compliant with the law:

- Proposal submission: Organizations seeking CSR funding need to submit a proposal to the National CSR Fund or directly to companies. This proposal must outline the goals, impacts, and expected outcomes of the project.

- Accreditation: Beneficiaries should have a valid registration with the relevant authorities to prove that their initiatives are trustworthy and focused on meaningful outcomes.

The Tax Benefits of CSR Contributions

For companies, CSR isn’t just a social responsibility—it also offers financial benefits. Under the Mauritian Income Tax Act, businesses that make CSR contributions can deduct these expenses from their taxable income, thereby reducing their tax liability. However, these deductions are only applicable if the CSR funds are directed towards approved social or environmental causes.

The Bottom Line: Why CSR Matters

CSR in Mauritius isn’t just about giving back—it's about shaping a sustainable future. The law ensures that companies contribute to this future, while businesses enjoy tax breaks and enhance their corporate reputation. For NGOs and community organizations, CSR is a valuable source of funding that can drive meaningful social change.

In short, CSR is a win-win: it benefits companies, communities, and the environment, and is an essential part of a more sustainable, responsible business ecosystem. Whether you're a business owner or an NGO, understanding CSR and leveraging the opportunities it provides is a step towards a brighter, more equitable future for Mauritius.