Do You Know? Donating to a Charitable Institution in Mauritius Can Benefit You Too.

When we think of donations, we often picture helping someone in need — a child, a family, an elder, a community or a vulnerable group.

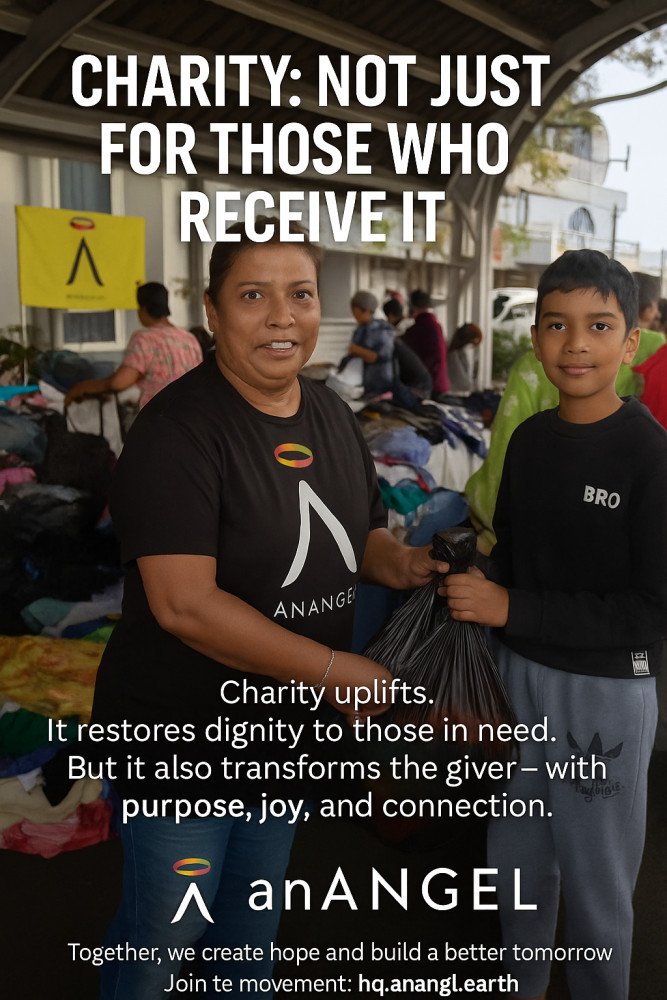

But in Mauritius, your donation to an MRA-approved charitable institution does so much more than uplift the community.

It can also reward you, the donor.

Surprising?

Most people don’t know this.

But today, we’re breaking it down clearly so that Mauritians can give with even more confidence and purpose.

💛 What Is a Charitable Institution?

A Charitable Institution, approved by the Mauritius Revenue Authority (MRA), is an organisation that operates exclusively for public good.

These institutions support:

-

Vulnerable families

-

Children and youth

-

Elders

-

Persons with disabilities

-

Health & wellbeing

-

Education

-

Environment & sustainability

-

Community development

When you donate to an MRA-approved charitable institution, you’re contributing to real, regulated, transparent impact.

But here is what many people don’t realise…

💡 Your Donation Can Benefit YOU Too

Mauritius has put financial incentives in place to encourage responsible giving.

Here’s how your generosity can also positively affect your finances:

💛 1. Tax Deduction for Individuals

From 1 July 2025, individuals who donate electronically to an MRA-approved charitable institution can claim a tax deduction of up to Rs 100,000 per year.

That means:

-

You help others

-

You reduce your taxable income

-

Your donation becomes both meaningful and financially smart

A win for you. A win for the community.

💼 2. CSR Benefits for Companies

All companies in Mauritius must contribute 2% of their chargeable income to CSR.

When donating to an MRA-approved charitable institution:

-

The contribution can count toward CSR requirements

-

Companies receive official receipts and reporting

-

The donation is aligned with national priority areas

-

The partnership is transparent, compliant and impactful

Businesses meet their legal obligations while uplifting society.

⭐ 3. Triple Deduction for Selected Causes (Companies)

Mauritius goes even further.

For specific sectors and MRA-approved priority activities, companies may benefit from a triple deduction (3× the value donated), capped at Rs 1 million.

This makes high-impact giving even more attractive for corporates – especially those looking to create lasting social change while receiving tax advantages.

❤️ Why This Matters

Giving is powerful.

Giving with understanding is transformational.

When donors are informed, they give with:

-

More confidence

-

More consistency

-

More intention

-

More impact

And when charitable institutions are recognised by the MRA, donors enjoy full transparency, compliance, and peace of mind.

🌍 Ready to Make an Impact?

Your donation can:

✨ Change a life

✨ Strengthen a community

✨ Support national development goals

✨ AND reward you through tax benefits

That is the power of giving in Mauritius.

👉 Want to donate safely to an approved charitable institution?

👉 Want to support meaningful causes and benefit from tax advantages?